Royal Road Minerals Inks Deal To Purchase AngloGold Ashanti’s Colombian Exploration Assets

Royal Road Minerals Limited (TSXV:RYR), a Canadian mining operation trading on Toronto’s TSX Venture Exchange announced last week that it has entered into a definitive stock purchase agreement with Compañía Kedahda Limited, an affiliate of AngloGold Ashanti Limited to acquire Northern Colombia Holdings Limited. NC Holdings in turn owns Exploraciones Northern Colombia SAS (“ENC”) which owns a title package comprised of mining concession agreements covering approximately 36,000 hectares of land (89,000 acres), and the rights with respect to applications that have been made to acquire mining concessions over approximately 215,000 hectares (531,000 acres) of land, in prospective mineral belts in the Nariño, Cauca and Antioquia departments of Colombia.

Royal Road Minerals to acquire over 2000 square kilometers of appraised and prioritized mineral exploration titles and title applications containing drill-ready targets

Highlights of the Transaction

- High quality, Appraised and Prioritized Title Package. AngloGold Ashanti has elected to focus on its three advanced projects in Colombia and in Q2 of 2018, commenced a sales process for its exploration title packages outside of these three principal projects including the Titles as held under NC Holdings and ENC. These title packages are the result of systematic exploration, appraisal, prioritization and the purposeful reduction of land holdings by AngloGold Ashanti over the years since inception of its activities in Colombia in 2004.

- Increased Future Optionality. The Transaction will significantly increase the Company’s portfolio of potentially Tier 1 exploration assets and provides the Company with various options for joint-venture and cash generating transactions in Colombia

- Advanced Exploration Potential. The Transaction provides the Company with access to drill-ready potentially Tier 1 projects on granted concession agreements within its present area of interest and elsewhere in prospective mineral belts throughout Colombia

Click on images to enlarge

The Properties

The Titles are grouped into two blocks, the Southern Block, which is located contiguous with Royal Road’s existing 3500 square kilometers of exploration rights in Nariño Province and the Northern Block, which covers the well-known Middle Cauca Belt, a region hosting over 50 million ounces of recently discovered gold resources (see Figure 1). There are 16 currently identified individual gold project areas located within the title package and numerous underexplored areas which management believes host significant geologic potential. Royal Road’s initial focus will be on granted titles containing targets that can be moved to the drilling-stage as soon as possible. Some of these targets are as follows:

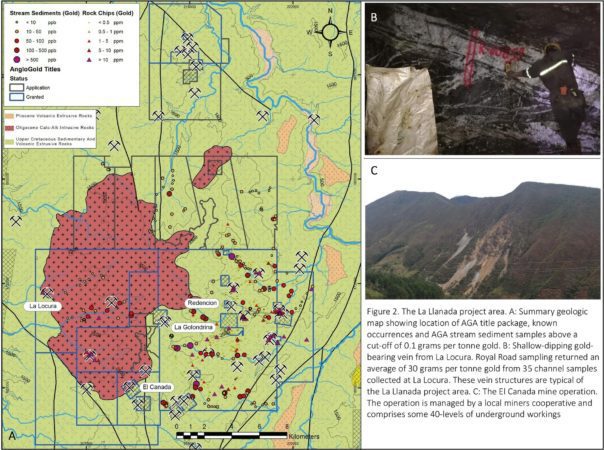

- The La Llanada project area in Nariño Province, characterized by very high stream sediment sample results and comprising several currently known high-grade vein-gold systems, (see Figure 2) and surrounding the La Redención mining license, over which the Company has an option agreement and is permitted to drill (see press release dated April 4, 2016)

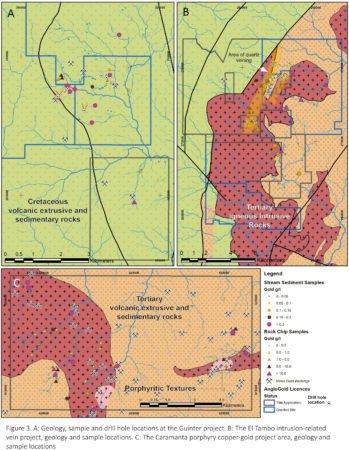

- The El Tambo intrusion-related gold project in Cauca Province, where AngloGold Ashanti reported an area of steep-moderate dipping quartz-veins, up to 3 meters wide, over 3 kilometers in strike length and 600 meters in total zone-width and with rock chip results returning up to 77 grams per tonne gold (based on a reported 182 combined panel and grab rock-chip samples ranging from below detection limit and with a mean of 2.2 grams per tonne gold; Figure 3)

- The Güinter sheeted quartz-calcite-sulfide vein project area in Antioquia. The vein system has been mapped over 6 square kilometers, AngloGold Ashanti drilled 10 scout diamond drill holes for a total of 5662 meters at the project and reported best intersections of 56 meters at 1.1, 14 meters at 1.8 and 20 meters at 1.8 grams per tonne gold (not true thickness). Based on geological observations management believe there is volume potential in mineralized stratabound horizons and potential for higher-grade mineralization where veins link and interact similar in style to the nearby Buriticá and Anzá projects (Figure 3).

The title package contains numerous porphyry-style occurrences and two well-known porphyry copper and gold projects that whilst not drill-ready, will be the short-term focus for Royal Road’s social and permitting teams

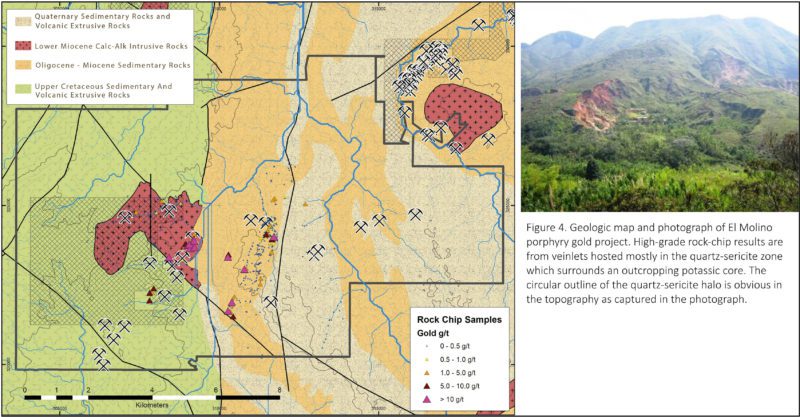

- The El Molino porphyry gold project (Figure 4) is an outcropping gold porphyry system located in Cauca Province. Both the potassic core and quartz-sericite halo of the system are exposed on surface. AngloGold Ashanti previously reported sheeted gold veinlets returning rock-chip samples of up to 184 grams per tonne gold (based on a reported 493 combined grab and panel samples ranging from below detection limit with a mean of 2.5 grams per tonne gold; Figure 3).

- The Caramanta region in Antioquia, where AngloGold Ashanti reported three copper and gold bearing porphyry bodies and rock-chip results of up to 47 grams per tonne gold and 3.3% copper (based on 255 combined grab and panel samples ranging from below detection limit with a mean of 0.65 grams per tonne gold and 0.07% copper).

Transaction Details

All figures are in United States dollars unless otherwise indicated.

Under the terms of the Agreement, the Purchaser agreed to acquire from the Seller all of the issued and outstanding shares of NC Holdings. NC Holdings indirectly holds, through two wholly owned subsidiaries, all of the issued and outstanding shares of ENC, which is the holder of the mineral concession Titles and is the assignee of the rights to any Titles that are granted to AngloGold Ashanti Colombia S.A. (the “Assigning Company”), an affiliate of Anglo Ashanti, pursuant to title applications made by the Assigning Company to the National Mining Agency of Colombia (Agencia Nacional de Minería).

In consideration for the purchase of the shares of NC Holdings, the Company agreed to pay the Seller a purchase price of $4,655,462 on completion of the Transaction. In addition, the Company has granted the following contingent considerations to the Seller:

- If at any time after the closing of the Transaction, Royal Road Minerals completes a technical report pursuant to NI43-101 that discloses for the first time an inferred mineral resource of not less than one million gold equivalent ounces on a specific area within the lands subject to any of the Titles held by the Company or any of its affiliates, such specific area shall be designated as a “Specific Project”, and the following provisions shall apply with respect to each such Specific Project identified:

o An amount equal to five million dollars ($5,000,000) shall be payable within 90 days following the date on which such technical report for the Specific Project is completed; and

o a further amount equal to five million dollars ($5,000,000) shall be payable within 90 days following the date on which a feasibility study for such Specific Project is completed and delivered to the Seller; and

o a further amount equal to five million dollars ($5,000,000) shall be payable within 90 days from the commencement of commercial production for the Specific Project; and

o a further aggregate amount equal to twenty million dollars ($20,000,000), payable in four equal installments of five million dollars ($5,000,000) on the date that is 90 days following the end of each of the Company’s four consecutive fiscal quarters immediately following the commencement of commercial production for the Specific Project.

- If at any time after Closing, the Company completes a feasibility study that discloses for the first time an inferred mineral resource of not less than five million gold equivalent ounces on a Specific Project, the Seller shall have a one-time option (the “Feasibility Option”) to purchase a 75% interest in the Specific Project for a purchase price in an amount equal to the sum of the following amounts:

o An amount equal to three (3) times the aggregate sum of all exploration expenditures up to and including the feasibility study funded by Royal Road Minerals; plus

o An amount equal to the aggregate sum of all exploration expenditures funded by Royal Road Minerals for that Specific Project from the feasibility option date until the completion of the transfer of the purchased interest.

If the Seller exercises the Feasibility Option for a Specific Project, then the Company will no longer be required to pay the payments on and following commercial production for the Specific Project for which the Seller has exercised the Feasibility Option.

The Agreement contains customary representations, warranties, covenants and conditions for transactions similar to the Transaction. In addition, the obligations of the Company to complete the Transaction are subject to the fulfilment of certain conditions on or before the closing of the Transaction, including, among others, the following conditions:

- The Company shall have completed a financing for aggregate gross proceeds of at least $3.5 million on or before the date that is 60-days from March 4th 2019; and

- the Company shall have obtained any required approvals of the TSX Venture Exchange and the relevant authorities in Jersey in connection with the acquisition contemplated by this Agreement.

- The Seller shall have obtained the required approval to implement the Transaction from the South African Reserve Bank.

The Transaction is expected to close on or before the date that is 60-days from March 4th 2019, subject to the approval of the TSX Venture Exchange and the other conditions precedent set out in the Agreement.