Fitch Says Colombia’s Removal of Reliability Charge Threatens Electric Utility Sector

Proposed modifications to Colombia’s electricity Reliability Charge (Cargo por Confiabilidad) have the potential to impact the operational cash flow of power generation companies (GenCos) and deter future investments, according to an analysis from Fitch Ratings. The report suggests these changes could heighten the risk of power shortages in the country.

The Colombian government is evaluating the elimination or reformation of the Reliability Charge, a mechanism that compensates power generators for the availability of their assets. This charge is a significant revenue source for GenCos, particularly those with a focus on thermal power. The proposed changes are aimed at reducing electricity costs for consumers.

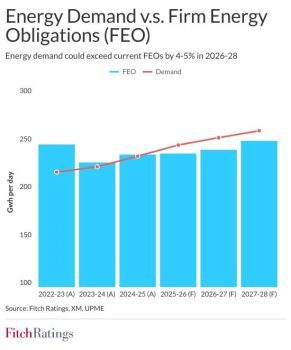

Energy Demand vs. Energy Obligations. Credit: Fitch Ratings.

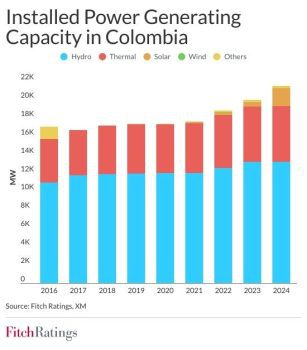

Colombia’s energy matrix is highly dependent on hydroelectricity, which supplies between 60% and 70% of the nation’s power. The Reliability Charge was designed to encourage the expansion and diversification of the generation infrastructure by compensating GenCos for maintaining the capacity to fulfill Firm Energy Obligations (FEOs), which are assigned through auctions. The mechanism is intended to ensure a consistent energy supply, especially during periods of low rainfall, functioning similarly to capacity and power charges in other countries.

For Termocandelaria Power, which operates exclusively thermal generation assets, the Reliability Charge can constitute more than 20% of its total revenue and a larger portion of its operating cash flow. The company provides critical electricity capacity on Colombia’s Atlantic coast, which helps address demand peaks and energy volatility, mitigating shortfalls from hydroelectric plants and transmission constraints.

Other GenCos with more diversified portfolios and less reliance on thermal generation, such as Enel Colombia and Empresas Publicas de Medellin, receive an average of 10% to 15% of their total revenue from the charge. Isagen (BVC: ISG), which also has a diversified portfolio, is also in this group.

Installed Power Generating Capacity in Colombia. Credit Fitch Ratings.

The potential changes to the Reliability Charge come as the Colombian power sector faces increased stress. In recent years, electricity supply growth has not kept pace with demand, a trend attributed to environmental issues and conflicts with local communities. A drought in 2024 caused a spike in spot electricity prices, though FEOs were sufficient to cover the reduction in hydroelectric generation. However, a future drought could necessitate energy rationing.

Fitch estimates that from 2026 to 2028, energy demand could exceed current FEOs by 4% to 5%, following the last reconfiguration auction in May. Modifications to the Reliability Charge could exacerbate this shortfall by inhibiting GenCos’ capacity to fund capital expenditures.

Above photo: Turbine chamber at the Hidroituango hydroelectric dam. (Photo credit: EPM)