Colombian Mining Investors Say Good Environmental Stewardship is Good Business

A significant majority of investors, 88%, believe that companies prioritizing ESG initiatives represent superior return opportunities compared to those that do not. Mining companies that proactively communicate the geological potential of their deposits in conjunction with their progress in environmental, social, and organizational governance, and performance (ESG) are more likely to withstand scrutiny, assess threats, and secure investment flows. This is indicated by the BlackRock World Mining Trust plc.

While BlackRock’s investment strategy does not exclusively prioritize ESG outcomes, it generally avoids investments where ESG risks have not been assessed or are significant. A company that has not invested adequately in integrating sustainability aspects may experience a disruption in its capital cycle and encounter challenges in its acquisition or merger plans.

The regulatory landscape in Colombia is following a similar trend. In 2021, the Superintendencia Financiera de Colombia published a technical document proposing a unified methodology for ESG reporting. The methodology for creating the report should be based on transparency, quality, and consistency of information.

The aim is to reduce the qualitative gap between large and small companies, not only for regulatory purposes but also to improve the social relationship and public perception of mining activity, and to boost the sector’s financial market.

The Superintendencia de Sociedades has established guidelines for incorporating international reporting standards into sustainability practices. These guidelines were published in External Circular 100-000010 on November 21, 2023. The circular indicates that it is recommended that the mining sector adhere to international standards for sustainability reporting. These reports should be published at least once a year for stakeholder information, as well as on the company website.

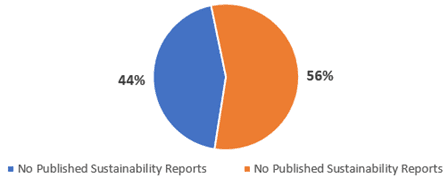

Figure 1. Percentage of disclosure of sustainability reports by mining companies in Colombia.

The Asociación Colombiana de Minería (ACM) is a professional association representing companies in the mining sector, including those engaged in exploration, production, and services. Of the 66 member companies, 95% have a website that communicates the company’s profile, corporate, investment, and interests to stakeholders.

Of the 52 companies engaged in mineral exploration or production, 44% report on sustainability under GRI or SASB standards. The majority of these companies focus on large-scale metallic minerals and coal. It is important to note that the majority of companies that do not publish sustainability reports are engaged in the production of industrial minerals (48%), followed by metals (34%).

It is evident that a significant proportion of companies, constituting 52%, that do not disclose Environmental, Social and Governance (ESG) information through official reports, do present relevant data on their websites. However, these companies are not adhering to the established national guidelines for the disclosure of such information.

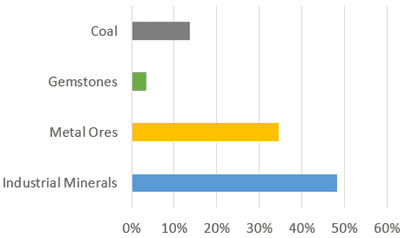

Figure 2. Non-report published mining companies segmented by mineral sector.

The remaining 48% of companies, primarily engaged in the production of industrial minerals, do not disclose ESG information to their stakeholders. These results indicate that there is still significant work to be done in Colombia for mining companies of all scales and the Colombian Mining Association to effectively communicate ESG targets with all stakeholders and regulators.

While the costs of preparing and disclosing a sustainability report may be considered high for small-scale junior production companies, mining associations can offer support and encouragement in the structuring of ESG-based reporting initiatives required by regulatory entities.

Environmental protection groups, some of which may have political interests, have taken advantage of the lack of proper information by introducing popular initiatives to prevent mining activities that could affect important investments in the short or long term.

The town of Buriticá in Antioquia has been the location of both legal and illegal mining. (Credit: Loren Moss)