Collective Mining Expands San Antonio Porphyry System with High-Grade Drill Results

Collective Mining Ltd. (NYSE: CNL) (TSX: CNL) announced that recent drilling at its San Antonio Project’s Pound target has confirmed the presence of a high-grade porphyry system and expanded its known footprint. The results, particularly from drill holes SAC-18 and SAC-15, indicate a mineralized zone that remains open in multiple directions, with a newly identified strike length of at least 450 meters. The project is situated in the Caldas Department of Colombia, near the company’s flagship Guayabales Project.

Key Drill Intercepts from the Pound Target

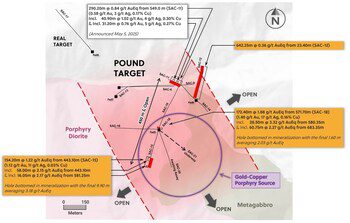

Drilling at the Pound target has focused on defining a recently discovered porphyry system. Two of the latest holes, SAC-18 and SAC-15, were drilled from the same pad and successfully intersected significant mineralization.

Figure 1: Plan View of the San Antonio Project Highlighting the Mineralized Corridor of the Pound Target and Significant Assay Results Announced Today and Previously (CNW Group/Collective Mining Ltd.)

Hole SAC-18: Drilled vertically 250 meters south of the discovery hole SAC-11, SAC-18 intersected multiple mineralized zones. The hole returned 172.40 meters at 1.88 g/t gold equivalent (AuEq), including a higher-grade section of 28.50 meters at 3.32 g/t AuEq and another section of 60.75 meters at 2.27 g/t AuEq. The hole was terminated prematurely due to rig limitations while still in strong mineralization, with the final 1.60 meters averaging 2.03 g/t AuEq. The company noted that this hole cut a late-stage porphyry-related sheeted vein system before entering the main gold-copper-silver-molybdenum porphyry system.

Hole SAC-15: Drilled to the south-southwest at a flatter angle from the same pad as SAC-18, this hole intersected a gold-rich zone of sheeted veinlets. Key results include 154.20 meters at 1.22 g/t AuEq, with higher-grade intervals of 58.00 meters at 2.15 g/t AuEq and 16.05 meters at 2.17 g/t AuEq. Similar to SAC-18, this hole was also stopped due to rig depth capacity, with the final 9.90 meters averaging 3.18 g/t AuEq.

Drill holes SAC-11, SAC-15, and SAC-18 have tested a north-to-south strike length of approximately 450 meters, with the system remaining open. To address the rig limitations that have prematurely ended several holes, the company has upgraded all rigs at the San Antonio Project. A higher-capacity rig is currently drilling hole SAC-21.

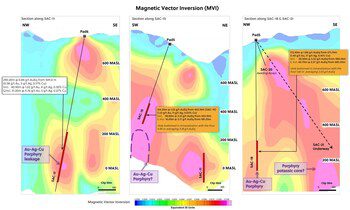

Figure 2: Cross-section along SAC-11, SAC-15, SAC-18, and SAC-21 showing the High MVI Anomaly Correlated with Au-Ag-Cu-Mo Porphyry Mineralization at the Pound Target (CNW Group/Collective Mining Ltd.)

Mineralization and Geological Context

Collective Mining’s geologists have identified three distinct, porphyry-related mineralized phases at the Pound target:

Phase 1: This phase is a large, 3-by-3-kilometer porphyry halo zone characterized by phyllic alteration. It hosts low-grade gold mineralization (0.2-0.5 g/t Au) and extends from the surface to a depth of at least 700 meters. This large zone covers the entire San Antonio project and includes multiple targets like Pound, COP, Euro, and their western extensions.

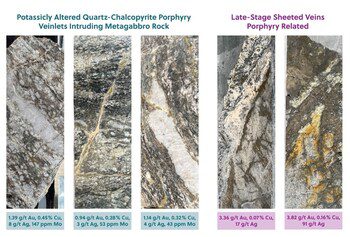

Phase 2: Described as a late-stage, gold and silver-rich sheeted veinlet system, this phase begins near the surface but shows more robust grades from 300 meters downhole. This mineralization is located in proximity to or in contact with the Phase 3 porphyry system.

Phase 3: This is the core gold-copper-silver-molybdenum porphyry system. It is characterized by potassic alteration and begins at approximately 400 meters below the surface. A notable feature of this phase is an unusually high gold-to-copper grade ratio, which can be as high as 4:1.

Figure 3: Drill Hole SAC-18 Split Core Highlighting the Gold-Copper-Silver-Molybdenum Porphyry Mineralization (Left) and the Late-Stage High-Grade Gold and Silver Sheeted Porphyry Veinlets (Right) Encountered from Drilling at the Pound Target (CNW Group/Collective Mining Ltd.)

Both Phase 2 and Phase 3 mineralized zones are found within the larger Phase 1 porphyry halo. The company is using Magnetic Vector Inversion (MVI) modeling of airborne geophysical data to help guide drilling. The current hole, SAC-21, is being directed toward a high MVI anomaly.

Project and Corporate Overview

Collective Mining’s drilling campaign for 2025 is fully funded with a target of 70,000 meters. The company is operating eleven drill rigs, with three dedicated to the San Antonio Project and eight at the Guayabales Project.

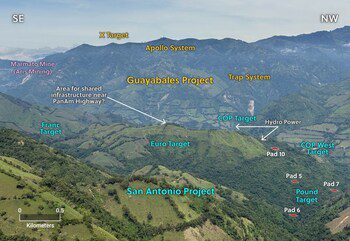

The San Antonio Project’s location, between 2 and 5 kilometers east-northeast of the Guayabales Project, offers the potential for shared infrastructure in the future. Executive Chairman Ari Sussman commented on the project’s scale and logistical advantages, noting its proximity to the Pan-American Highway and existing hydropower lines.

Collective Mining was founded by the team that developed and sold Continental Gold Inc. to Zijin Mining. The company’s Guayabales Project is anchored by the Apollo system, a large-scale, bulk-tonnage gold-silver-copper-tungsten system. The company’s current work at Apollo includes defining shallow mineralization and expanding high-grade zones. Collective is listed on both the NYSE and TSX under the ticker symbol “CNL”. The company’s ownership structure is heavily concentrated, with management, insiders, a strategic investor, and close associates holding a 44.5% stake.

Figure 4: Image of the San Antonio Project and its Targets (foreground) and the Guayabales Project (background), highlighting the Potential for Shared Future Infrastructure. Note the Hydro Power and the Vastly Unpopulated Landscape (CNW Group/Collective Mining Ltd.)

David J. Reading, a qualified person under National Instrument 43-101 (“NI 43-101”), has reviewed and verified the technical information in this report. Sample analysis is conducted at SGS and Actlabs facilities in Colombia and Canada. The company utilizes a standard QA/QC program, and no capping has been applied to the reported grades. The gold equivalent (AuEq) calculations are based on specific metal prices and recovery rate assumptions.