Aris Mining Reports Q2 2025 Financial Results, Announces Sustainability Report Publication

Aris Mining Corporation (TSX: ARIS) (NYSE American: ARMN) has announced its financial and operational results for the first half and second quarter ending June 30, 2025. The company also released its 2024 Sustainability Report, available for review on the Aris Mining website. All financial figures are reported in US dollars.

Q2 2025 Financial Performance

Aris Mining reported record revenue of $200.2 million, an increase of 30% from the previous quarter and 75% from the second quarter of 2024. The increase was attributed to higher gold prices and increased sales volumes.

The company’s cash balance increased to $310 million as of June 30, 2025, up from $240 million at the end of the first quarter. This resulted from cash flow from operations and proceeds from the exercise of ARIS.WT.A warrants. After the quarter’s end, the company received an additional $60.5 million from warrant exercises that expired on July 29, 2025. Total proceeds from these warrants amounted to $114.8 million, with a 98.7% exercise rate.

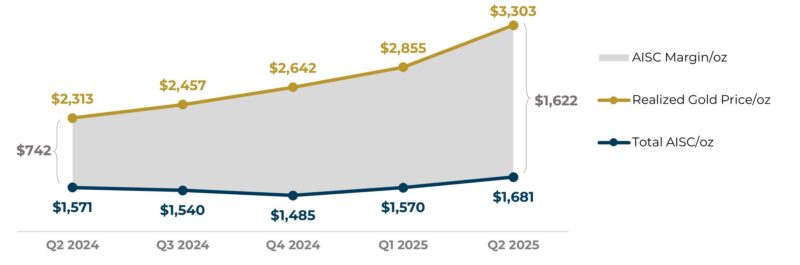

Figure 1: Strong AISC Margin Growth ($ million) – Segovia (CNW Group/Aris Mining Corporation)

Adjusted EBITDA reached $98.7 million, a 48% increase from the first quarter of 2025 and a nearly threefold increase from the same period in 2024. Over the trailing 12 months, Adjusted EBITDA was $264.0 million. The company invested $36.7 million in growth capital, with $23.6 million allocated to the Marmato Bulk Mining Zone and $6.9 million to the Segovia operations.

Adjusted net earnings were $47.8 million, or $0.27 per share, the highest since the company’s formation in September 2022. This represents an increase from $0.16 per share in Q1 2025 and $0.08 per share in Q2 2024. A non-cash loss of $45.5 million was recognized in Q2 2025 from fair value adjustments to the company’s warrant liability. This liability, valued at $40.8 million as of June 30, 2025, has been fully extinguished following the expiration of the warrants on July 29, 2025.

| Q2 2025 | Q1 2025 | Q2 2024 | |

|---|---|---|---|

| Gold production (oz) | 58,652 | 54,763 | 49,216 |

| Gold sold (oz) | 61,024 | 54,281 | 49,469 |

| Segovia – AISC, Owner Mining ($/oz sold) | $1,520 | $1,482 | $1,616 |

| Segovia – CMP AISC Margin (%) | 42% | 41% | 34% |

| Adjusted EBITDA ($M) | $98.7 | $66.6 | $36.1 |

| Adjusted net earnings ($M) | $47.8 | $27.2 | $12.7 |

| Adjusted earnings per share ($/share) | $0.27 | $0.16 | $0.08 |

Q2 2025 Operational Performance

Gold production for the quarter totaled 58,652 ounces, a 7% increase from the 54,763 ounces produced in Q1 2025. Production is anticipated to increase throughout the second half of 2025 following the commissioning of the second mill at the Segovia operations in June 2025.

The Marmato Narrow Vein Zone produced 7,125 ounces, consistent with Q1 2025 levels and a 29% increase over Q2 2024.

The Segovia Operations produced 51,527 ounces, supported by an average gold grade of 9.9 g/t and gold recoveries of 96.1%.

All-in Sustaining Cost (AISC) margin increased to $87.2 million, a 43% increase from Q1 2025. The trailing 12-month AISC margin reached $250.4 million.

Owner-operated Mining AISC was $1,520 per ounce sold, bringing the first-half 2025 average to $1,503 per ounce, which is within the company’s full-year guidance range of $1,450 to $1,600.

Gold sourced from Contract Mining Partners (CMPs) delivered an AISC sales margin of 42%, contributing to a 41% margin for the first half of 2025, exceeding the full-year guidance range of 35% to 40%.

Total AISC increased to $1,681 per ounce sold, up from $1,570 in Q1 2025. This increase was attributed to higher gold prices, which raised costs associated with material purchased from CMPs, as well as royalties and social contributions linked to gold sales.

| Q2 2025 | Q1 2025 | Q2 2024 | |

|---|---|---|---|

| Average realized gold price ($/oz sold) | $3,303 | $2,855 | $2,313 |

| Tons milled (t) | 167,960 | 167,150 | 155,912 |

| Average gold grade processed (g/t) | 9.85 | 9.37 | 9.14 |

| Gold produced (oz) | 51,527 | 47,549 | 43,705 |

| AISC margin ($M) | 87.2 | 60.9 | 32.2 |

Growth and Expansion

The company’s operations generated $74.6 million in cash flow after sustaining capital and income taxes in Q2 2025. After accounting for expansion capital, Aris Mining generated a net cash flow of $37.9 million.

Figure 2: Total AISC and Realized Gold Price Trends ($/oz) – Segovia (CNW Group/Aris Mining Corporation)

Segovia Operations Commissioning of the second ball mill at Segovia in June 2025 is expected to increase gold production throughout the second half of the year. With ongoing underground development and increased mill feed from CMPs, the company maintains its guidance for annual production of 210,000 to 250,000 ounces this year and a target of 300,000 ounces for next year. A total of $6.9 million was invested in Q2 2025 to support the plant expansion, underground development, and exploration.

Marmato Bulk Mining Zone Construction of the Marmato Bulk Mining Zone is advancing. The project, which involves a porphyry-hosted gold-silver system, is being developed using bulk underground mining methods. Decline development is in progress to access the mineralized zones. Earthworks for the main substation have been completed, and earthworks for the carbon-in-pulp (CIP) plant platforms are nearing completion. The company invested $23.6 million in the project during Q2 2025. First ore and production ramp-up are projected for the second half of 2026.

Soto Norte Project: A new Pre-Feasibility Study (PFS) for the Soto Norte Project is currently underway and is expected to be completed in Q3 2025. This study includes a smaller-scale development plan and processing options intended to support local small-scale miners. Following the PFS, Aris Mining plans to submit the necessary studies to apply for an environmental license for the project’s development.

Toroparu Project: A new Preliminary Economic Assessment (PEA) for the Toroparu Project is in progress and is expected to be completed in Q3 2025. The PEA will evaluate updated development options following the March 2023 mineral resource update and subsequent infrastructure optimization studies.

Aris Mining in Segovia. Photo credit: Aris Mining Segovia/Facebook.