The Communications Regulation Commission (CRC) of Colombia has released its “Study of OTT Digital Services Platforms 2024,” concluding that there is no technical evidence to justify charging over-the-top (OTT) platforms for using the country’s telecommunications networks. The study, which analyzed the interaction between users, telecom operators, and digital platforms, found that data traffic growth has decelerated significantly in recent years.

The CRC’s analysis, developed after public consultations with operators, platforms, and academic institutions, determined that the relationship between these three parties is mutually beneficial. Digital platforms drive demand for data, telecom operators provide the necessary connectivity, and users gain access to a wider variety of services and content. The study found no evidence linking the increase in data traffic to unexpected or unplanned investments by operators, considering traffic growth a predictable part of network planning.

The study detailed several key findings regarding digital consumption in Colombia:

- Traffic Growth: The annual growth rate of data traffic in Colombia fell from 103% in 2021 to 10.1% in 2024. This trend contradicts the argument that OTT platforms should be obligated to pay operators for network usage.

- Local Traffic: The majority of fixed and mobile internet traffic now circulates through local peering or cache systems, which may be related to the increased number of data centers deployed by digital ecosystem players.

- Smartphone Use: Smartphone ownership increased from 84% in 2021 to 88% in 2024. Of the surveyed users, 74% use online applications for calls (up from 66% in 2021) and 78% for messaging (up from 69% in 2021). WhatsApp (WhatsApp), owned by Meta Platforms, Inc. (Nasdaq: META), was identified as the most used messaging platform.

- Content Platforms: Approximately 32% of surveyed individuals over 15 years old access audiovisual content platforms. The most used were Netflix (Netflix: NFLX) and Disney+ (The Walt Disney Company: DIS). In the audio sector, 92% of respondents did not have a paid subscription. Among those with a subscription, Spotify (Spotify Technology S.A.: SPOT) was the most used at 47%, followed by YouTube Premium (Alphabet Inc.: GOOGL, GOOG) at 23%.

The report also highlighted that while the use of digital services is increasing, digital infrastructure remains concentrated in major cities, which may limit quality and access in peripheral regions.

Based on its findings, the CRC has outlined four strategic lines of action, some in collaboration with the Ministry of Information and Communications Technologies (MinTIC):

- Regulatory Project: A new regulatory project with a normative impact analysis will be launched to further analyze the relationship between OTT platforms, operators, and users.

- Reporting Adjustments: The CRC plans to adjust information reporting requirements to monitor user traffic by network type and platforms accessed.

- New Study: A new study will be conducted to identify and disseminate tools that help users avoid unsolicited content.

- Child Protection: The CRC will work with MinTIC to promote the safe use of technology and protect children and adolescents, in compliance with Law 2489 of 2025.

Video streaming. Photo credit: Frank_Rietsch from Pixabay.

In September 2025, during ANDICOM 2025—Colombia and the Andean region’s annual information and communications technologies (ICT) congress organized by CINTEL, Network operator InterNexa, a technology services provider with 25 years of operational experience, announced an expansion of its service portfolio. The company, which operates in Colombia and Peru with commercial presence in the United States, is evolving from primarily a connectivity operator to a provider of integrated technology services across three main verticals: technology services and cybersecurity, infrastructure and cloud services, and connectivity. This strategic shift is aimed at supporting government entities, mining and energy companies, and other telecommunications sector participants in their digital transformation initiatives.

As part of this expansion, InterNexa introduced its new Security Operation Center (SOC) service. This solution is designed to provide organizations with comprehensive cybersecurity management and strengthening capabilities. The SOC is characterized as an advanced monitoring and response center that integrates technology, automation (including artificial intelligence and machine learning), and intelligent real-time analysis to anticipate and effectively respond to cyber threats. The launch of the SOC is set against a backdrop of increasing cyberattacks in Colombia; the Ministry of Information and Communications Technologies (MinTIC) reported approximately 36 billion attempted cyberattacks in Colombia during 2024, positioning the country as the second most targeted in Latin America, accounting for 17% of total attempts.

InterNexa’s capabilities in cybersecurity, cloud, data center, and managed services are intended to support public entities in technology and innovation procurement processes. The company is part of Grupo ISA (BVC: ISA), which in turn is part of Grupo Ecopetrol (NYSE: EC, BVC: ECOPETROL), Colombia’s largest company. This affiliation provides a foundation for high-availability, scalable, and secure solutions, leveraging ISA’s 57 years of experience in critical infrastructure.

During ANDICOM, Loren Moss, executive editor of Finance Colombia, was able to spend a few minutes with InterNexa CEO Saúl Kattan to discuss the company’s strategy and objectives under his leadership; first during a press conference, followed by an exclusive one-on-one interview.

During the press conference with Saúl Kattan before the one-on-one interview, Kattan had these comments:

“This is the most important event Colombia has had. I don’t think there is any other event with as many attendees as ANDICOM. More than 6,000 attendees registered for the event. On the one hand, we are celebrating 40 years of ANDICOM, and on the other, we are celebrating 25 years of InterNexa, which is very important to us. So, we wanted to bring you all together and tell you about a few things. From InterNexa’s perspective, and from the National Government’s perspective.

I believe that from the National Government’s side, we continue to work on connectivity in the regions. We continue to make progress on various issues related to digital transformation. I believe that the most important issue is connectivity. It is how we can truly close the digital divide that exists in the country. Today, we are talking about connectivity of around 60-65%. It depends on how we measure it or who measures it. However, those people who are not connected are clearly the least well-off, the most in need. And this obviously leads to inequality. So, we need to work hard on the issue of connectivity. It should not be a plan of one government or another. This has to be a union of all the forces of the next government to push connectivity forward. It makes no sense to keep talking about new technologies, about being leaders in artificial intelligence, when all this does is increase the digital divide. Increase the difficulties between the most privileged and the least privileged.

So, to do this, we need to close that digital divide, connect Colombia, connect the country, and then we can think about new technologies. New humanized technologies, new technologies that we think about how they help people. They help people truly thrive, truly get ahead. Not just having technologies for the sake of having them. Like, now we have artificial intelligence. So what? How does it help us? How does it help ordinary people? How does it help all of us to have a better quality of life? So that’s from the government’s side. If you want, we’ll open it up for questions, and then we’ll move on to InterNexa.”

Finance Colombia: I’m here with Saúl Kattan: Kattan, the CEO of InterNexa. We are here at ANDICOM 2025. First, Saúl Kattan: thanks for making time. I know that you’re very busy closing deals and not only managing InterNexa —congratulations on that role— but you also have another position, helping the MinTIC, or the Ministry of Telecommunications, Information and Communications. If you would, tell us a little bit about your responsibilities there.

Saúl Kattan: Well, thank you for the invitation. Not only MinTIC, I’m trying to advise the government of Colombia in digital transformation. All the strategy around cybersecurity, all the strategy around data, data centers, cloud, and artificial intelligence. So that’s what I’m working on as a strategy proposition to the government in these aspects. And of course, InterNexa, which is an important player in the market.

Finance Colombia: Things are moving very quickly. We look at what artificial intelligence is doing. But you also mentioned cybersecurity. And I’ve seen several studies that show that Colombia, as a country, including the private sector, but then of course with the government as well, there are gaps when it comes to knowledge, best practices, as well as having the technical infrastructure. What are the steps that the government, but then even the private sector, like here at ANDICOM, what are the steps that we need to take here in Colombia to catch up, to make sure that the country has good defenses against cyber threats?

Saúl Kattan: I think that the most important part is the governance in cybersecurity. We have proposed to create an agency, a cybersecurity agency, that has to go to congress. Unfortunately, congress has denied this law project. The government will insist. But without an agency, a cybersecurity agency that can bring together all the entities, all the public entities, all the government into one agency, it will be very difficult. Other than that, of course, there’s technology. Different types of technology can work.

Another issue is people. We have to train people. There’s a big gap in the number of people with the knowledge of cybersecurity. We calculate that we need around 150,000 more people trained for cybersecurity. So, at the end, if we bring the government, if we bring the technology, and we bring the people, the training of people, I think we can have something more robust for the country.

Finance Colombia: InterNexa is a wholesaler, and you provide services to large-capacity consumers such as cell phone operators and such. What would this security role you’re talking about look like? How can you offer that to the end user? Would it be through the wholesale customers?

Saúl Kattan: Yes, we would not reach the end user. InterNexa’s focus is on wholesale connectivity. We serve operators and CSPs. We have a very important network, a very important neutral network, but we also provide technology services to the minor energy sector and the government sector. So the focus is on these entities, which in turn reach the end user in one way or another. So indirectly, we are reaching the end user, but the idea is to be able to continue focusing on the companies and sectors we are serving. We do not have the capacity at this time to reach the end user. Hopefully, in the future, but at this time, we do not have the capacity.

Finance Colombia: As someone with extensive experience in entities and companies with State or government participation, such as ETB, Ecopetrol, or InterNexa, what is the key to managing the interests of shareholders, whether they be the state, consumers, or private shareholders? If I remember correctly, ETB, for example, is about 80% government-owned and 20% Ecopetrol-owned, more or less. InterNexa has several shareholders. As an executive, how do you strike that balance? If you were advising a young executive, how would you advise them to survive? What would it be like?

Saúl Kattan: I believe that the great challenge for public companies is consistency. There really is no consistency in corporate governance. It often depends on politics. When the government changes, the people change. Sometimes during a government’s term, people change simply for political reasons. And as long as there is no long-term consistency, no long-term strategy, it’s a bit like what I was saying about the country’s connectivity. And the same applies to companies. You see private companies with presidents who last six, seven, eight, 10, or even 20 years. And they have a strategy. And the strategy is being fulfilled. Some are better than others, but it is being fulfilled.

In public companies, unfortunately, governments change and people change. And when people change, they come back and start from scratch because they think, “Well, this comes from the previous government, so let’s do the opposite.” And we see this at ETB. The company was doing wonderfully well, and then it was a debacle. Simply because of a political decision. Now they are trying to rescue it, but we have been in a debacle at ETB for 10 years. The stock dropped 95%. And what happened? Nothing happened. Because it was a political issue. And the financial damage that was done was enormous. If this had been maintained, not even the administration, but if the strategy had been maintained, today ETB would be worth four or five times more than it was 10 years ago. So I recommend that. That you have to maintain a certain long-term strategy for things to work.

Finance Colombia: I remember 10 years ago, when I lived in Bogotá, at the time you were leading ETB, and ETB rolled out something very impressive, and that was fiber to the household. And that was very new at the time, and Colombia was a leader in that, and that was under your leadership there. I now live in Antioquia. I have fiber optic to the house, and I tease some of my friends back in the US that I have double and triple the speeds in a rural area of Antioquia that they can get at any cost, unless they went to an enterprise plan or something like that, back in the States, in some areas, and that’s really amazing.

What have been the keys to success in rolling out fiber? Not just with InterNexa, which obviously is a wholesale provider to the carriers and large enterprises, but you also have experience at the retail level. And how has Colombia led with the adoption of fiber optic as a standard, as opposed to an exotic alternative?

Saúl Kattan: Well, no, I think fiber optic is the best technology that we can have for connectivity. I believe that now, I believed this 10 or 12 years ago when I got to ETB, that was a big project to show that ETB was not a phone company. It was much more than that. We took advantage of all the pipelines, all the networks that ETB had, and we deployed fiber. We were the first ones in Colombia, one of the first ones in the region. We were leaders in bringing fiber to Bogotá. At that time, 100 megabytes per second was amazing. Today it’s very good, but at that time it was outstanding.

Finance Colombia: Exactly.

Saúl Kattan: And of course, that took other companies to see what was happening in ETB, to see what the customers believed that fiber could do, and they started deploying fiber around the country.

Finance Colombia: To catch up.

Saúl Katta: To catch up, and to other countries as well. But today, even today, 10 years later, we can see that Bogotá is a more advanced place in Colombia with fiber.

Finance Colombia: Now, at InterNexa, you have a role as an enterprise that has the State and other entities with shared ownership in InterNexa, and so aside from being a company, you have a public purpose and a public mandate. We just got finished talking about how great things are in Bogotá, how great things are in Medellín, but there are parts of Colombia… We’re here on the Caribbean coast, we’re in Cartagena, but we can go a couple more hours and we’re in La Guajira, or the other way towards Panama, and we’re back in the Gulf of Urabá, or Chocó, or the south like the Amazon and Vaupés and those areas. So in Bogotá, Medellín, everything is world-class, but there are parts of Colombia that maybe have a lot of catching up to do. What is the role that InterNexa can play as a backbone provider, the social side of things, to help advance and equalize that connectivity?

Saúl Kattan: I do believe that Colombia has a big gap in connectivity. Today, 30 or 40%, depending on how you measure things, of people in Colombia do not have connectivity or have very bad connectivity. And I do believe that it doesn’t matter if you do a deployment to low-income areas to make things profitable. You can do a business providing fiber, providing connectivity to all these places that you mentioned that do not have connectivity. And I think that it’s possible. I think that in some places, maybe we need a little bit of help, financial help from the government. But other than that, I think there are a lot of places where if we get the fiber there, it will bring connectivity. There are a lot of ISPs, small ISPs, that can bring connectivity to the households and decrease the connectivity gap. So I think it is possible. I think it’s possible.

I think that InterNexa is a profitable business. We do business to make money because of our return for our investors, which is ISA. But of course, we can help the people. We can help all these regions with no connectivity, being a profitable company. I don’t think they’re going the wrong way.

Finance Colombia: Great. So that means that with ISA, InterNexa is generating profits; it doesn’t need government subsidies. Right now, when we’re in a fiscal crunch here in Colombia, it’s actually helping to solve the problem rather than saying, “Hey, we need subsidies” or things like that.

Saúl Kattan: Yes, of course. The problem of places like Colombia and many other countries is that the big carriers want to have the big markets, of course. That’s where the meat is. That’s where the big profits are. So you go to Bogotá, you go to Medellin, you go to Cali, Barranquilla, Cartagena, the big cities. But when you have to go to other places, you have to make a much bigger effort to get there. It becomes much more difficult. There are profits, but probably a lower amount of profits.

Finance Colombia: Right.

Saúl Kattan: But at the end, if you can make both, if you can bring all the fiber, the big networks to the big cities, but also to the small cities, I think that the complement is great for the country. And it will bring more profits for everyone. Because if there’s connectivity, there will be more opportunities for the people. There will be better health for the people. There will be a lot of places where people can go for tourism. And it will bring more consumption of the internet.

Finance Colombia: Absolutely.

Saúl Kattan: And it will increase the use of the fiber. So, at the end, it is a win-win situation for everyone.

Finance Colombia: I think just like roads, the fiber optics and connectivity backbone, whatever technology, if it’s a microwave or a satellite or fiber, is the great driver these days, even more so than roads, as was the case, let’s say, in the 20th century. Because, you know, it breaks my heart. I was in parts of La Guajira, and I saw little communities. They didn’t even have cellular access, let alone internet access. They have no access at all. And so even if you’re a school, even if you’re a student and you do your part, it doesn’t matter because you’re going to be left behind without that. And so it’s so critical to get these services to these areas where you can develop that human talent.

Saúl Kattan: It is critical and it is very important for the development of the country. You don’t have to go to La Guajira to see this. When you go 20 minutes away from Bogotá, you can see it. There is no connectivity or very bad connectivity. You cannot hold a conference call going from Bogotá to La Calera. Where La Calera is, for the people that don’t know, is basically a part of Bogotá.

Finance Colombia: Yeah, it’s a suburb in the northeast.

Saúl Kattan: A big part of Bogotá, yeah. So there’s a lot of work to do. There are a lot of opportunities. There are a lot of investments to be made. And it’s about time. It’s about money. And it’s about the consistency of the next government and the next couple of governments that we can continue working and doing things. Unfortunately, politics work in a different direction. And when another government comes, they want to change everything. And then you don’t get the benefits of a long-term strategy.

Finance Colombia: Exactly. And I guess I would say don’t feel too bad because as we can see, that’s not a problem unique to Colombia. Back in my own home country, we have the same problems, in other parts of the world as well. But you’ve been very successful navigating this. I think I first met you back at ETB, and I’ve followed your career since then. You’ve had success doing your part at Ecopetrol, of course. And that’s almost impossible. It’s like one of those reality shows. You know? So congratulations. You’ve been able to have a positive impact wherever you go. And I appreciate your time. I want to let you get back to the deal-making and the moving and the shaking as we do here. And it’s great to see you again.

Saúl Kattan: Thank you very much.

Finance Colombia: Absolutely.

Saúl Kattan: Thank you. Thank you for your time.

Alma Air S.A.S., a Colombian air transport company, has received a favorable opinion from the Technical Advisory Committee on Aerocommercial Affairs (CTAA) of the nation’s Civil Aviation Authority (Aerocivil). This regulatory decision permits Alma Air to initiate its formal certification process under the air taxi service modality, utilizing both amphibious and land-based versions of the Cessna Grand Caravan C208 aircraft.

The company plans to establish its operational base in Cartagena, focusing initially on the Caribbean coast before expanding its proposed service network nationwide. Alma Air’s business model centers on connecting historically remote communities, specialized tourist regions, and island destinations.

Alma Air CEO Rupert Stebbings. Photo credit: Rupert Stebbings.

The favorable concept, documented under CTAA Act No. 006, specifically noted that Alma Air’s proposal constitutes an “innovation in the tourist connectivity of the Caribbean region” and recommended its approval. The opinion marks the transition of the company’s plans from the conceptual phase into the formal regulatory audit process before Aerocivil.

Rupert Stebbings, CEO of Alma Air, commented on the development, stating that the regulatory step facilitates the company’s plan for regional service. “Whilst the initial project is directed towards the Caribbean coast, once certified, Alma will serve all of Colombia,” Stebbings said. “We seek to connect the country safely, efficiently, and sustainably, with a proposal that combines modern technology and a strong sense of public service.”

The aircraft chosen for the planned operation, the Cessna Grand Caravan C208, is manufactured by Textron Aviation, a subsidiary of Textron Inc. (NYSE: TXT). Alma Air’s deployment of amphibious aircraft aims to expand air coverage across coastal, island, and rural areas that lack traditional runway infrastructure.

The company is positioning the project as a mechanism to strengthen territorial integration and contribute to regional economic development, citing the potential for generating foreign investment within the key transportation sector. Alma Air must now finalize the rigorous technical and operational procedures required by the Civil Aviation Authority to obtain the necessary Air Operator Certificate (AOC).

Alma Air. Photo credit: Alma Air.

Copper Giant Resources Corp. (TSXV: CGNT, OTCQB: LBCMF, FRA: 29H0) has announced initial bench-scale metallurgical test results for its Mocoa copper-molybdenum project in Putumayo, Colombia. The preliminary findings indicate strong recoveries, with up to 92.3% for copper and 97.4% for molybdenum, which exceed the 90% copper and 75% molybdenum recovery assumptions currently used in the project’s resource model.

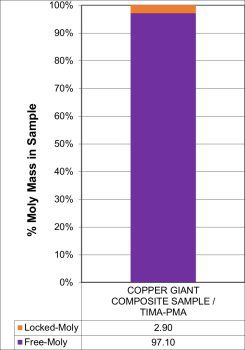

Figure 1 – Molybdenite liberation on sample (CNW Group/COPPER GIANT RESOURCES CORP.)

The test work, conducted and supervised by SGS del Perú S.A.C., an independent ISO/IEC 17025-accredited laboratory, represents the first phase of a comprehensive metallurgical program. This program aims to establish a conceptual processing flowsheet to support a future Preliminary Economic Assessment (PEA). The company cautions that these results are based on a single 130 kg composite sample and may not be representative of the entire deposit. Further variability and locked-cycle testing are required.

The metallurgical program involved a series of staged tests, including comminution, flotation, and mineralogical characterization, on a composite sample sourced from three drill holes.

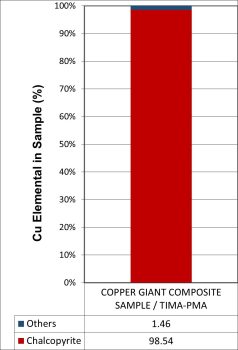

Mineralogical characterization confirmed that copper is predominantly hosted in chalcopyrite, a common and easily processed copper sulfide mineral. Molybdenum is present exclusively as molybdenite. Analysis using X-ray Diffraction (XRD) and a TESCAN Integrated Mineral Analyzer (TIMA-X) showed that minerals containing deleterious elements like arsenic were not detected in significant quantities, suggesting the potential for producing clean concentrates.

Liberation studies indicated that both chalcopyrite and molybdenite are effectively liberated at a relatively coarse grind size with a P80 (80% passing) of 150–180 micrometers (µm). At this grind size, 97% of the molybdenite was observed as free grains.

The flotation testing process was optimized for grind size, pH levels, and reagent suites.

Grind Size: A grind size of P80 150 µm was identified as the preferred condition, balancing recovery and processing costs. At this size, copper recovery reached 88.1% and molybdenum recovery was 96.2%.

pH Level: Tests conducted across a pH range of 9 to 11 showed robust flotation performance. A pH of 11 was selected as the base case for subsequent tests, yielding a copper recovery of 88.9%.

Reagent Optimization: The highest recoveries were achieved during reagent optimization tests. The addition of PAX (Potassium Amyl Xanthate) as a secondary collector (Test 01) resulted in a copper recovery of 92.2% and a molybdenum recovery of 97.4%.

Figure 2 – Copper-bearing mineral on sample. (CNW Group/COPPER GIANT RESOURCES CORP.)

The Mocoa project is situated approximately 10 kilometers from the town of Mocoa in southern Colombia. Copper Giant holds granted titles and applications for over 790 square kilometers in the region, which is part of the Jurassic porphyry belt, a geological formation that extends into Ecuador.

The deposit was first discovered in 1973 through a regional survey by the United Nations and the Colombian government. Subsequent exploration was carried out between 1978 and 1983, with additional drilling conducted by B2Gold Corp. (NYSE: BTG, TSX: BTO) in 2008 and 2012. The deposit remains open for expansion in all directions.

The results from this initial program will inform the design of the next phase of metallurgical testing. Copper Giant has outlined that future work will focus on developing an integrated flowsheet, optimizing regrind and reagent schemes to maximize recovery, and testing for concentrate quality and marketability. These advanced studies will provide the technical basis for a PEA.

Last Thursday, the Mayor of Medellín, Federico Gutiérrez, shared via Twitter/X a letter that he sent to the United States government, specifically addressing the US Department of State, the Federal Bureau of Investigation (FBI), and the Drug Enforcement Administration (DEA). The letter, dated July 2, 2025, expresses “profound institutional concern” over the security situation in the city. Gutiérrez alleges that the current Colombian government’s national policies are “allegedly favoring, directly and indirectly, criminal structures.”

Gutiérrez’s communication highlights a public event held on June 21, 2025, in Medellín titled “A Pact for the Urban Peace of Medellín,” which was promoted by the Presidency of the Republic of Colombia. During the event, nine individuals identified as leaders of criminal organizations were brought onto a stage and presented as “peace spokespersons.”

The mayor’s letter notes that these individuals have firm convictions for various crimes, including homicide, narcotics trafficking, forced disappearance, and extortion. Among those present were Juan Carlos Mesa Vallejo, alias “Tom,” and Freyner Alfonso Ramírez García, alias “Pesebré,” both of whom are on the Specially Designated Nationals and Blocked Persons List maintained by the US Department of the Treasury‘s Office of Foreign Assets Control (OFAC).

Mi carta al FBI, DEA, Departamento de Estado de los Estados Unidos 🇺🇸 y Embajada 🇺🇸 sobre el “Tarimazo” de Petro en Medellín con los peores criminales. Algunos de ellos en el radar de los Estados Unidos por tráfico de drogas. Son 7 páginas. Adjunto 4. pic.twitter.com/K0ToeAFh6r

— Fico Gutiérrez (@FicoGutierrez) September 25, 2025

The letter also states that the release of these individuals from the Itagüí prison was not authorized by a judge. It further alleges that the release was requested by Senator Isabel Cristina Zuleta López of the Pacto Histórico political coalition. Senator Zuleta defended her actions in a statement to W Radio, asserting that it was “inexplicable” not to include the leaders of the criminal structures in a public dialogue about urban peace, as they had been recognized by the president for such talks.

Criminal Structures and Transnational Ties

The letter details the history of criminal organizations in Medellín, from the Medellín Cartel of the 1980s to modern-day groups. It names several prominent organized crime groups (G.D.O.s), including “El Mesa,” “Los Chatas,” “Pachelly,” and “La Terraza,” stating that they continue to operate international narcotics trafficking networks.

Gutiérrez’s letter alleges that these Colombian criminal structures have alliances with international organizations such as the Tren de Aragua, Cártel de Jalisco Nueva Generación, the Sinaloa Cartel (OTCMKTS: SRBAL), and the Albanian Mafia, among others.

Information Leak at the Attorney General’s Office

In his letter, Gutiérrez also raised concerns about alleged irregularities within the Colombian Attorney General’s Office. He claims that an investigation into Juan Pablo Taborda Samora, alias “Yordi,” and Daniel Muñoz Olaya, the son of criminal leader José Leonardo Muñoz Martínez, alias “Douglas,” was compromised. According to the letter, information regarding an impending arrest operation against Daniel Muñoz was allegedly leaked, preventing his capture. This alleged leak informed “Douglas” of the ongoing investigation against his son, allowing them to evade authorities.

Click on images to enlarge and view originals:

Letter from Mayor Federico Gutierrez to the US Government

The mayor states that there are 7 total pages, but he published only these four above, which appear to be redacted.

Page 1

Seal of the Mayor’s Office of Medellín

Mayor’s Office of Medellín District of Science, Technology, and Innovation

Medellín, July 02, 2025.

Respected

United States Department of State, Federal Bureau of Investigation (FBI), Drug Enforcement Administration (DEA), US Embassy Bogotá.

Subject: Submission of relevant information regarding the critical security situation and transnational criminality in Medellín, Colombia.

I, Federico Gutiérrez Zuluaga, in my capacity as Mayor of the Special District of Science, Technology, and Innovation of Medellín, identified with NIT 890.905.211-1, respectfully address you to express profound institutional concern over recent events that, stemming from the national policy of the current Colombian Government, are allegedly favoring, directly and indirectly, criminal structures that have historically affected the security of both our city and that of its international allies, among them, the United States of America.

As is widely known by the international community, Medellín has a complex history linked to organized crime. Indeed, from the 1980s, when the Medellín Cartel dominated the global drug trade, to the present day, the city has been a strategic hub for transnational criminal activities. The criminal structures that mutated from a centralized model to fragmented yet interconnected networks, such as the self-styled “Oficina de Envigado” and the current Organized Crime Groups (hereinafter G.D.O.) and Organized Common Crime Groups (hereinafter G.D.C.O.), maintain a very high criminal capacity with international reach.

Today, the 10 G.D.O.s present in Medellín and the Aburrá Valley—among them “El Mesa,” “Los Chatas,” “Pachelly,” “La Terraza,” “Robledo,” and “La Sierra”—and G.D.C.O.s such as “San Pablo” and “La Oficina del Doce,” continue to operate international narcotics trafficking networks with destinations primarily in North America and Europe. These structures maintain active alliances with cartels such as the “Tren de Aragua”, “CJNG”, “Sinaloa Cartel”, “Albanian Mafia”, “Choneros”, “Lobos”, “Cartel de los Soles”, “Maras Salvatruchas”, “Ndrangheta”, “Camorra”, among others, which demonstrates the internationalization of their criminal activities.

Despite this grave and evident reality, the current National Government of Colombia, led by President Gustavo Petro Urrego, has promoted a policy that, under the discourse of “Total Peace,” has publicly legitimized criminal leaders with serious judicial records, many of whom are apparently still active in drug trafficking, exploitation of minors and adolescents, arms trafficking, human trafficking, and other illegal revenues of transnational interest.

Thus, on this past June 21, 2025, during the public event called “A Pact for the Urban Peace of Medellín,” which was promoted by the Presidency of the Republic of Colombia, nine (09) of the top leaders of these structures¹, among them individuals included on the OFAC (Office of Foreign Assets Control) List such as Juan Carlos Mesa Vallejo (alias “Tom”) and Freyner Alfonso Ramírez García (alias “Pesebré”), were displayed on stage as “peace spokespersons,” despite having firm convictions for atrocious crimes (such as homicide, narcotics trafficking, use of minors for the commission of crimes, forced disappearance, extortionate kidnapping, extortion, and criminal conspiracy, among other crimes of extreme gravity) and even though, apparently, they continue to control their criminal structures from the penitentiary center where they are imprisoned (particularly, in the Itagüí prison – Antioquia). This event was also attended by the Minister of Justice and Law (Eduardo Montealegre Lynett), the Minister of the Interior (Armando Alberto Benedetti Villaneda), the Minister of National Education (José Daniel Rojas Medellín), the Minister of Labor (Antonio Sanguino Páez), the Minister of Mines and Energy (Edwin Palma Egea), the Minister of Cultures, Arts and Knowledge of Colombia (Yannai Kadamani Fonrodona), Senators of the Republic Isabel Cristina Zuleta López and León Fredy Muñoz Lopera, Representatives to the Chamber for Antioquia Alex Xavier Flórez Hernández and Pedro Baracutao García Ospina, the Representative to the Chamber for Valle del Cauca Alfredo Mondragón Garzón, and the former mayor of Medellín, now charged by the Office of the Attorney General of the Nation for alleged acts of corruption, Daniel Quintero Calle, among others.

Now, this public act signified a grave institutional violation. This, since it was an act of re-victimization for the people affected by these criminal groups, who have seen their victimizers legitimized in a political setting, without authorization from a Judge of the Republic to leave their place of imprisonment, even though they all currently have a final conviction (and it is being served). Likewise, the departure from the prison was supported by a request from the Historic Pact senator, Isabel Zuleta Cristina Zuleta López.

The foregoing raises serious questions about the separation of powers, due process, and the principle of equality before the law, given that, under the current legal framework, there is no legal basis for reaching an agreement with criminal structures, which does not amount to a submission to justice.

Furthermore, the foregoing occurred in a complex context, not only local but also national. This is because there have apparently been undue leaks of sensitive information and possible undue pressure in high-impact processes, namely:

In events surrounding recent procedural actions carried out by the Attorney General’s Office in the country against members of the G.D.O. “La Terraza,” among them Mr. Juan Pablo Taborda Samora, known in criminal jargon as “Yordi” (the top leader and boss of hitmen for said organization), and against Daniel Muñoz Olaya, son of José Leonardo Muñoz Martínez (alias “Douglas”), arrest warrants were issued against them for different crimes which they apparently took part in to integrate said criminal organization, who, according to the Prosecutor’s Office, are involved in money laundering and illicit enrichment. However, despite details of this operation having been filtered by irregular third parties, which could have jeopardized the success of all the captures (apparently alerting the targets before the proceedings began), and compromising the security of the Judicial Police investigators and the designated prosecutor’s office itself.

Indeed, as was evidenced in an extraordinary security meeting held in the District of Medellín this past June 17, 2025 (which included the participation of the Unit Against Organized Crime of the Attorney General’s Office, the National Police, the National Army of Colombia, the Colombian Air Force, and representatives of state intelligence agencies) and in a meeting on June 19, 2025 aimed at conducting a presentation of the balance of operational results by the National Police, it was established that there was a leak of information hours before the operation, since alias “Douglas” had been informed of a respective investigative process against his son and that his capture would be imminent.

As a result of this situation, not only would the capture of Daniel Muñoz Olaya have been prevented (by evading the action of the public force at the time of the execution of the search with (Additional text appears to be missing beyond this point. The mayor states that there are 7 total pages, but he is making public these four, redacted. -Ed.)

FOOTNOTES:

1: In effect, these are José Leonardo Muñoz Martínez (alias Douglas), Juan Carlos Mesa Vallejo (alias Tom), Jorge de Jesús Vallejo Alarcón (alias Vallejo), Juan Camilo Rendón Castro (alias el Saya), Albert Henao Acevedo (alias Albert), Juan Fernando Álvarez (alias Juan XXIII), Walter Román Jiménez (alias el Tigre), Freyner Ramírez García (alias Pesebré), and Dayron Alberto Muñoz Torres (alias El Indio).

Footnote 2 appears to be redacted.

3: Copy of the official letter of transfer for the competence of relevant information filed on June 25, 2025, before the Attorney General’s Office by the Secretary of Security of the District of Science, Technology, and Innovation of Medellín.

4: Copy of the official letter of transfer of relevant information for the pertinent purposes and request for urgent and necessary protection measures filed on June 25, 2025, before the Attorney General’s Office.

5: Copy of a news article published on June 26, 2025, by Revista Semana.

6: World Drug Report 2025 by UNODC: Global instability aggravates the social, economic, and security impact of the global drug phenomenon, published on June 26, 2025, by the United Nations Office on Drugs and Crime.

7: Copy of the publication made on July 1, 2025, on the social network “X” by Caracol Radio.

Sincerely,

[Signature]

Federico Andrés Gutiérrez Zuluaga, Mayor of Medellín.

Fitch Ratings (Fitch Ratings), the global credit rating agency, has stated that the announced consolidation of four fiduciary subsidiaries of Grupo Aval Acciones y Valores S.A. (Grupo Aval) through a spin-off will not have immediate implications on their current credit ratings. The four companies—Fiduciaria Bogotá (Fiduciaria Bogotá), Fiduciaria de Occidente (Fiduciaria de Occidente), Fiduciaria Popular (Fiduciaria Popular), and Aval Fiduciaria (Aval Fiduciaria)—are set to merge into Aval Fiduciaria, which will be the beneficiary entity.

As a result of this announcement, the existing credit risk ratings for Aval Fiduciaria and Fiduciaria de Occidente, as well as the quality ratings for investment management for Fiduciaria Bogotá, Fiduciaria de Occidente, and Aval Fiduciaria, will remain unchanged. Fitch’s conclusion is based on the financial strength of the publicly traded parent company, Grupo Aval (NYSE: AVAL, BVC: AVAL-C).

Fitch’s position is supported by Grupo Aval’s international issuer default rating of ‘BB+’ with a negative outlook. The ratings agency also considered Grupo Aval’s management’s strategic and operational plan, which is focused on consolidating a leading entity in terms of assets under management, capturing synergies, and incorporating best practices from each fiduciary company into internal processes. At this stage, Fitch has not identified any changes in the individual credit profiles or the governance frameworks for investment management that would justify a rating action.

However, the agency noted that executing the consolidation and integration plan could lead to operational and business adjustments. Fitch will monitor these changes as the regulatory and corporate processes advance. The agency will continue to evaluate key implementation milestones, performance metrics, the evolution of operational risks, and the stabilization of each process. Fitch stated that it will communicate any developments that could lead to a rating action in the future.

Grupo Aval at the Bolsa de Valores de Colombia. Photo credit: Grupo Aval/Facebook.

The Comisión de Regulación de Comunicaciones (CRC) has released its latest Postal Services Data Flash, an update on traffic, revenue, and service quality for the country’s mail, express messaging, and postal money order services for 2024. The report indicates a positive performance for the sector, with express messaging establishing itself as the fastest-growing service with the largest market share.

The report, presented in an interactive format, allows for data disaggregation by multiple variables. For the first time, it includes quality indicators for mail service and reincorporates those for express messaging, in addition to a general overview of market share and the number of operators.

In 2024, the postal sector’s total revenue reached $2.7 billion, a 10.8% increase from 2023, marking a historical record over the last five years. During this period, 360 million shipments were processed. Express messaging accounted for 80% of this traffic, with postal money orders at 13.5% and mail service at 6.5%.

Express messaging was the leading service in the postal sector for 2024, generating $2.38 billion in revenue, which represented 87.5% of the market. This figure reflects a 19.1% increase compared to 2023. The service handled 289 million shipments, a 3.7% increase from the previous year. Of these, 56.2% were domestic, 35.5% were local, and 8.3% were international.

The average revenue per shipment was $8,391 at constant prices, representing a real growth of 7.8% from 2023. In terms of company market share, Interrapidísimo led with 15.3% of shipment volume, followed by Servientrega with 12.7%.

The official postal operator, 4-72, handled 23 million shipments in 2024, generating $84.214 million in revenue. While this was a nominal increase, after adjusting for inflation, it represented a real decrease of 3.9%. The universal postal service contributed 17% of the mail service’s revenue and 16% of its total shipment volume.

Correspondence constituted 96% of these shipments, accounting for 87% of the revenue. The average revenue per mail shipment was $3,665, a real decrease of 5.4% from 2023.

In 2024, postal money order services processed 49 million transactions. Of these, 99.7% were domestic, while international transactions were split 64% inbound and 36% outbound. These transactions generated $257 billion in revenue, which marked a 31.3% decrease from 2023 at constant prices.

Regarding market share, Supergiros led with 40.3% of transactions, followed by Efecty (32.2%) and SU RED (26.5%). The average revenue per money order was $5,375. After accounting for inflation, this figure showed a real decline of 9%, primarily attributed to a reduction in the average revenue of both domestic (-8.8%) and international (-6.5%) money orders.

In 2024, only 65.3% of express messaging shipments were delivered within the agreed-upon timeframe, while the universal postal service provided by 4-72 had an on-time delivery rate of 78.2%.

Additionally, 99.9% of express messaging shipments were delivered in good condition to their recipients or returned to the sender. Similarly, 100% of non-universal mail service shipments were delivered in good condition.

EPM Capital México S.A. de C.V. and EPM Latam S.A., both subsidiaries of Grupo EPM (a state-owned company by the Municipality of Medellín, not publicly traded), have agreed to sell 100% of the shares of Tecnología Intercontinental, S.A.P.I. de C.V. (TICSA), a Mexican company specializing in the design, construction, operation, and maintenance of water treatment systems. The buyer is Colombian infrastructure company Odinsa S.A.

The enterprise value of the transaction is up to $2.905 billion MXN, equivalent to approximately $609 billion COP based on the current exchange rate. The equity value of the transaction is up to $1.598 billion MXN, representing approximately $335 billion COP.

The agreement has been signed, but the transaction’s completion is contingent on a series of closing conditions, including the approval of the Mexican competition authority, the Comisión Federal de Competencia Económica (COFECE). The fulfillment of these conditions requires the joint effort of buyers, sellers, and other involved third parties, introducing an element of uncertainty regarding the final closing.

Since 2021, Grupo EPM has been evaluating options to improve TICSA’s performance and optimize its corporate portfolio. In line with this strategy, a decision was made in late 2023 to pursue a total divestment through an open and competitive sale process. The process invited 33 potential strategic investors and investment funds from various countries, including Canada, Spain, France, the United States, Japan, and Mexico. Odinsa ultimately submitted the most favorable offer and was selected for the final phase, culminating in the signing of the share purchase agreement.

“At Grupo EPM, we are adjusting our investment portfolio to focus our human and financial resources on markets and projects where we have greater opportunities for growth, value creation, and sustainability,” stated John Maya Salazar, general manager of EPM and leader of the EPM Group. “TICSA is a company with proven technical capabilities and a distinguished track record in the water sector. In the hands of a manager like Odinsa, with a strong investment capacity and proven experience in structuring, operating, and maintaining infrastructure assets, its development and expansion can be enhanced.”

In 2013, TICSA became part of Grupo EPM after a capital investment gave the company a majority stake, making it the first international water sector company in the corporate group. Subsequently, Grupo EPM acquired 100% of its shares in 2019. To date, TICSA has constructed and operated more than 160 water treatment plants, consolidating its technical leadership in Mexico and other markets.

Tecnología Intercontinental, S.A.P.I. de C.V. (TICSA). Photo credit: Ticsa Grupo EPM/Facebook.

In a significant development for Colombia’s economy, the country has canceled its Flexible Credit Line (FCL) with the International Monetary Fund (IMF). The move comes after the IMF suspended Colombia’s access to the funds in April 2025 and follows a critical assessment of the nation’s fiscal health, raising concerns among economists and political opponents about the country’s financial stability and credibility on the world stage.

IMF Cites “Considerable” Fiscal Weakening

The decision was formalized following the conclusion of the IMF’s 2025 Article IV consultation on September 29, 2025. The IMF’s Executive Board released a sobering assessment, noting that while economic growth has strengthened and inflation is easing, significant challenges remain.

The core of the IMF’s concern lies in Colombia’s public finances. The report highlights a “widening fiscal deficit and rising debt levels,” which have resulted in higher borrowing costs (elevated sovereign spreads) and weak private investment amid “lingering concerns and uncertainties over the direction of policies”.

A key point of contention is the Colombian government’s decision in June to invoke an escape clause, suspending its fiscal rule through 2027. The IMF board stated that due to “repeated fiscal slippages and the temporary suspension of the fiscal rule—a key policy anchor,” Colombia’s fiscal policy and framework have “deteriorated” and “weakened considerably” since the FCL was requested in 2024. Consequently, the country no longer meets the “very strong” assessment required for continued qualification for the FCL.

The IMF warned that further delays in fiscal consolidation could undermine investor confidence and potentially trigger a “sudden stop in capital inflows”. The organization urged Colombian authorities to implement a credible and decisive consolidation plan to “re-anchor expectations, lower borrowing costs, and improve the overall policy mix”.

Economic Projections and Risks

The IMF projects Colombia’s real GDP will grow by 2.5% in 2025, with inflation gradually easing to around 4.5% by the end of the year. However, it forecasts a challenging fiscal landscape, with the central government deficit reaching 7.1% of GDP in 2025 and gross public debt peaking at 62.3% in 2027.

The report also outlined significant external risks, including tighter global financial conditions, geopolitical tensions, and stricter immigration policies, which could disrupt exports, foreign direct investment, and remittances.

Government Defends Decision, Cites Strong Reserves

Colombia’s central bank, Banco de la República, announced the cancellation of the FCL, which was originally approved in April 2024 for two years and amounted to approximately $8.1 billion.

The bank stated the decision was based on the country’s adequate international liquidity levels, with international reserves reaching $65.5 billion. This position was strengthened by a reserve accumulation program and portfolio returns totaling $6 billion during 2024 and 2025. Central bank governor Leonardo Villar asserted that the country’s credit perception will not be negatively affected, stating that “the level of international reserves is strong enough to have supported the decision” and will not have “relevant financial implications”.

The bank clarified that the cancellation does not impact the payment schedule for a disbursement made in December 2020. As planned, the final payment is due in December 2025.

Critics Warn of Economic Fallout

The move has drawn sharp criticism from political opponents and economists, who view it as a serious blow to Colombia’s financial standing.

Mauricio Cárdenas, former finance minister and a presidential candidate, harshly questioned the decision, describing the FCL as a beneficial “cushion” for the country. He warned that it sends a negative message to international investors, particularly in a context of rising credit costs. “Colombia is paying a 13% interest rate on its financing, when 10 years ago it was 6% or 7%,” Cárdenas stated, adding that these higher costs reduce funds available for social investment.

#Economía| El exministro de Hacienda y candidato presidencial, Mauricio Cárdenas Santamaría, cuestionó con dureza la decisión del Gobierno Petro de renunciar a la Línea de Crédito Flexible con el Fondo Monetario Internacional (FMI).

“Estamos muy mal. En 24 horas, el ministro de… pic.twitter.com/LVsMnscpmw

— Jean-Pierre Serna (@jpserna) October 1, 2025

Economist Adriana Oviedo noted that the exit from the FCL “crystallizes a problem of fiscal credibility in Colombia”. She argued that without this external “shielding,” risk agencies will now focus more intensely on the country’s deficit and rigid government spending. In her view, the government is now “forced to make a non-discretionary adjustment to resume the debt path”.

La salida de la LCF del FMI cristaliza un problema de credibilidad fiscal en Colombia. Sin el "blindaje" externo, el foco de agencias de riesgo se centra en el déficit y la rigidez del gasto.

El Gob. se ve forzado a un ajuste no discrecional para reanudar la senda de la deuda. https://t.co/Q1ugSNuS1W

— Adriana Oviedo (@Adri_OviedoLL) September 30, 2025

Former Vice President Marta Lucía Ramírez characterized the move as “a step into an economic abyss,” claiming it distances Colombia from the stability achieved by previous administrations with the FCL’s support. Similarly, former consul

El informe del FMI advierte: déficit al 6.7%, deuda al 61.3%, y vulnerabilidad de la economia colombiana por la caída de commodities. La FCL legado del anterior gobierno,nos dio seguridad financiera. Petro nos lleva al borde del precipicio. ¡Colombia merece mejor!…

— Marta Lucía Ramírez. (@mluciaramirez) September 30, 2025

Former consul Claudia Bustamante called the decision “irresponsible,” warning that “without the backing of the IMF, Colombia loses international confidence, so there is more risk, more cost and more economic uncertainty”.

IMF Photo/Melissa Lyttle/Facebook.

In an unprecedented series of events that have sent shockwaves through the decades-long alliance between the United States and Colombia, the US Department of State has revoked the visa of Colombian President Gustavo Petro. The decision follows what the department described as “reckless and incendiary actions” by the head of state on the streets of New York City, where he was attending the United Nations General Assembly.

While his country grapples with escalating violence and economic uncertainty, President Petro chose to immerse himself in foreign conflicts, taking his activism to a protest in Times Square against Israeli Prime Minister Benjamin Netanyahu. There, alongside Pink Floyd co-founder Roger Waters, Petro grabbed a megaphone and delivered a fiery speech. The critical moment came when he directly called upon members of the United States Armed Forces to “disobey the orders of Donald Trump and obey the order of humanity,” a move that Washington interpreted as a direct incitement to mutiny—a felony under US law.

The State Department’s response was swift and unambiguous. In a statement posted on X (formerly Twitter), the agency declared, “Earlier today, Colombian President Gustavo Petro stood on a New York street and exhorted US soldiers to disobey orders and incite violence. We will revoke Petro’s visa due to his reckless and incendiary actions.” The statement underscored a fundamental principle of international alliances: “No responsible ally encourages members of the US Armed Forces to disobey the constitution or break military discipline.”

This diplomatic fallout is not merely a reaction to a single speech but the culmination of escalating tensions. The relationship between the Petro administration and Washington has been strained by disagreements over anti-drug policy, the ongoing crisis in Venezuela, and now, Petro’s vociferous stance on the Israeli-Palestinian conflict. The US recently “decertified” Colombia as a partner in counter-narcotics efforts, a symbolic but significant rebuke of Petro’s strategies, which have coincided with a surge in illicit coca cultivation.

President Petro has consistently framed US policy as “hypocritical” and “imperial,” using platforms like the UN General Assembly to lambast the United States for what he calls a “failed” war on drugs. His rhetoric has grown increasingly confrontational, accusing Washington of “pushing the world toward new wars.”

Domestic Backlash and Political Condemnation

The repercussions of Petro’s actions in New York have been felt acutely within Colombia, drawing sharp criticism from across the political spectrum. Opponents argue that the president has recklessly endangered a critical strategic partnership for the sake of ideological posturing on a global stage.

Federico “Fico” Gutiérrez, the two-time mayor of Medellín, laid the blame squarely on the president. In a post on X, Gutiérrez stated, “Petro has done everything to destroy Colombia’s relationship with the United States. It has been a premeditated strategy of provocation. I evidenced it in our agenda in Washington. Now don’t play the victim. The horrible night will soon cease. Petro is not Colombia. The United States is clear about that. Colombia needs a President who governs with his five senses and in his five senses. Colombia will get ahead.”

Similarly, former governor of Antioquia Sergio Fajardo called for Petro’s resignation, expressing his dismay on social media. “You finally did it, President Petro! You no longer have a visa for the United States. Now resign from the presidency and dedicate yourself to leading the third world war against Trump and his friends,” Fajardo wrote. He added, “He was not capable of thinking about his responsibility to Colombia or of protecting our country’s interests. He stopped governing a long time ago and will now go out to do politics as the victim he has always wanted to be. What an embarrassment, Mr. President!”

In response, Petro dismissed Fajardo’s criticism, retorting that “being president of Colombia does not depend on the US, it depends on the people. Understand that the people are sovereign.”

A Symbolic Strike with Historical Echoes

The revocation of a sitting president’s visa is a severe diplomatic rebuke. While it does not prevent President Petro from attending multilateral forums like the UN, it is a potent symbol of disapproval. The last time the US took such a drastic measure against a Colombian leader was in 1996, when President Ernesto Samper’s visa was revoked by the Clinton administration over substantial evidence that his presidential campaign had received funding from the Cali drug cartel.

Upon his return to Bogotá, Petro confirmed he had been notified of the visa cancellation, framing the US government’s decision as a violation of international law and the diplomatic immunity afforded to heads of state attending UN functions. “Separating the US from Colombia is what the mafias need,” he wrote on X, warning, “The headquarters of the United Nations cannot continue in New York.”

The protest in New York, which drew approximately 2,000 people, was organized by a coalition of groups including the Palestinian Youth Movement, Jewish Voice for Peace, and the Party for Socialism and Liberation. The Colombian delegation accompanying the president was also present, and they notably walked out of the UN General Assembly during Prime Minister Netanyahu’s address.

As President Petro pivots to domestic rallies, the long-term consequences of his diplomatic gamble remain to be seen. What is clear is that his actions have pushed the vital US-Colombia relationship into its most precarious state in a generation, prioritizing a crusade on foreign disputes over the stability of a cornerstone alliance.

President Gustavo Petro in New York, joining a rally for Palestine. Photo credit: Colombian Presidency.